سایت تخصصی حسابداران خبره ایران

ارائه مطالب تخصصی حسابداری و حسابرسی و قوانینسایت تخصصی حسابداران خبره ایران

ارائه مطالب تخصصی حسابداری و حسابرسی و قوانیندرباره من

نظرسنجی

نظرسنجی

نظرسنجی

روزانهها

همه- می خوای ازدواج کنی ؟ کلیک کن

- مطالب مذهبی ،تربیتی برای جوانان

- سوالات کارشناسی ارشد کلیه رشته ها سال ۸۶تا۹۰ دفترچه راهنما و سوالات کارشناسی ارشد و جواب اونا رو میخوای کلیک کن جانم

- مترجم آنلاین کلمه و متن فارسی به انگلیسی و با مترجم متن یخوای کلیک کن بیا تو

- اگر سلامتی را جستجو می کنید کلیک بفرمائید

- قرآن کتاب خدا

- قرآن شناسی

- اندرزهای نهج البلاغه شامل مطالب بسیار آموزنده

- دیکشنری آنلاین می خوای کلیک کن لطفا دیکشنری آنلاین انگلیسی به فارس و بالعکس آریانپور

- نشانی محاکم قضائی و رفع مشکلات حقوقی

پیوندها

- کانون مجازی حسابداران،حسابرسان و مدیران خبره

- موسسه حسابداری و حسارسی روان پرداز- مطالب علمی و تخصصی حسابداری

- بیا تو -- ببین

- دانلود استانداردهای حسابرسی

- سوالات کارشناسی ارشد حسابداری

- بانک مقالات لاتین حسابداری می خوای کلیک کن - 1600 مقاله حسابداری

- می خوای استانداردهای حسابرسی رو توی پاورپوینت مطالعه ک کلیک کن

- پایگاه قوانین مالیاتی- اگر سوال مالیاتی داری بیا تو

- دیکشنری آنلاین می خوای کیلیک کن

- انتقال تجربیات شخصی به نسل جوان

- نرخ ارز ها ی خارجی رامی خواهید اینجا رو کلیک کنید

- اگر مطالبی انگلیسی در مورد حسابداری مدیریت می خوای کلیک کن

- میخوای نهج البلاغه مطالعه کنی کلیک کنhttp://www.erfan.ir/farsi/nahj/nsm_proj/main.php

- مدیران محترم شرکتها - خدمات حسابداری میخواید؟ کلیک کنید لیست خدماتی که ما ارایه می دهیم

- میخوای استانداردهای مصوب حسابداری را دانلو کنی؟ کلیک کن در نوع مستند استاندارد - استانداردهای مصوب را انتخاب کن

دستهها

- موضوعات عمومی حسابداری 86

- موضوعات حسابرسی 43

- قوانین 122

- آزمونها ی حسابداری 7

- مطالب عمومی 74

- مطالب مذهبی 56

- جملات قصار موفقیت 4

- آگهی و تبلیغات 3

- صورت های مالی اساسی 4

- اصول حسابداری 24

- حسابداری میانه 49

- حسابداری پیشرفته 7

- حسابداری صنعتی 22

- حسابداری پیمانکاری 4

- حسابداری دولتی 10

- ریسک در حسابرسی 6

- حسابداری و حسابرسی شرکتهای کوچک 1

- استاندارد های حسابداری 47

- استانداردهای حسابرسی 1

- دیکشنری حسابداری 1

- نسبتهای مالی 5

- مطالبی برای مدیرا ن عزیز 58

- کدینگ در نرم افزارهای حسابداری 1

- تاریخچه حسابداری 1

- سود و زیان و سود و زیان جامع 1

- گزارشگری و حسابداری صنایع خاص 2

- حسابداری مدیریت 9

- مطالب مدیریتی 110

- مدیریت مالی 65

- بورس و نحوه سرمایه گذاری در آن 21

- جوک 6

- ضرب المثل ها 2

- لطیفه 9

- مطالب پزشکی ؛ سلامتی و تندرستی 18

- روشهای ارزیابی سهام 6

- آموزش اکسل 8

- آموزش کامپیوتر 3

- حسابداری منابع انسانی 1

- حسابداری اعتبارات اسنادی و شرایط 14

- آموزش نحوه سرمایه گذاری 13

- مطالب سیستمی و مرتبط با فن آوری 11

- متفرقه 32

- حسابداری اسلامی و چالشهای آن 5

- مقاله حسابداری حسابرسی ومدیریت 12

- ریسک در حسابداری 7

- حسابرسی 7

- مالیات 55

- قوانین چک 5

- اخبار مهم 9

- آموزش زبان انگلیسی و اصطلاحات آن 7

- داستانهای کوتاه و آموزنده 5

- تستهای حسابرسی 1

- حسابداری استهلاک 1

- قانون روابط موجر و مستاجر 1

- پول و موضوعات مربوط به آن 3

- استراتژی و طرحهای کارآفرینی 1

- کارآفرینی و کسب و کار 6

- مدیریت اسلامی 1

- آموزش زبان انگلیسی 5

- آیین نامه های مربوط به حسابرسی 4

- اساسنامه ها 1

- ازدواج موقت یا صیغه 2

- مطالب قضائی و آدرس محاکم قضائی 5

- زبانهای گزارشگری مالی و انواع آن 1

- مالیات بر ارزش افزوده 1

- ارضا جنسی و مطالب مربوط به آن 6

- فرم ها ی مورد استفاده در امور ما 1

- سوالات و مقالات انگلیسی و ترجمه 1

- موفقیت و عوامل آن 10

- بخشنامه های مالیاتی 1

- روانشناسی 17

- مدیریت استراتژیک 3

- ازدواج موقت 3

- جذب دبیر برای تدریس در منازل 1

- آموزش دروس از ابتدائی تا کنکور 1

- استخدام 11

- کسب و کار 11

- اطلاعیه ها و آزمون ها 1

- توصیه ها 11

- دعاهای صحیفه سجادیه عربی و فارسی 16

- مطالب مذهبی و دینی 7

- ارزیابی سهام 2

- قوانین و بخشنامه های تسهیلات بان 7

- راه و روش پولدار شدن 2

- راه های کاهش هزینه ها 2

- راه های افزایش لذت جنسی 2

- ارائه خدمات حسابداری حسابرسی 5

- فرق مردان و زنان ( ونوسی - مریخی 3

- آموزش حسابداری عملی 1

- آزمون ها 1

- مطالب علمی 10

- آدرس جدید محاکم قضائی 7

- کارشناس رسمی دادگستری 23

- ارزیابی اموال و دارائی و برند 3

- مسائل و قوانین بانکی 1

- انتخاب داور مرضی الطرفین در قراردادها 2

ابر برجسب

تنظیم اظهارنامه مالیاتی خدمات حسابداری افزایش سرمایه مازاد تجدید ارزیابی چک برگشتی خدمات مالیاتی ورشکستگی ارزیابی سهام بورس خدمات حسابرسی آدرس دادسراها آدرس مجتمع های قضائی تحریر دفاتر قانونی حسابداری حسابرسیبرگهها

جدیدترین یادداشتها

همه- فرآیند افزایش سرمایه شرکت

- حق بیمه قراردادهای پیمانکاری

- مالیات بر عایدی سرمایه چیست؟

- فعالسازی رمز پویا پیامکی

- میزان معافیت مالیاتی درآمد اجاره خانه

- آموزش تابع VLOOKUP در اکسل (به زبان ساده)

- آشنایی با استانداردهای بینالمللی گزارشگری مالی (IFRS)

- نحوه محاسبه ریسک و بازده

- ارتباط با جن

- داوری در باب هفتم قانون آیین دادرسی مدنی

- موافقت نامه داوری و شرط آن

- مهلت تسلیم اظهارنامه مالیاتی سال 1402صاحبان مشاغل

- موضوع ماده ۱۸۶ قانون مالیات های مستقیم و تفسیر تبصره های آن

- [ بدون عنوان ]

- [ بدون عنوان ]

نویسندگان

- علی 1210

بایگانی

- آذر 1403 2

- آبان 1403 2

- مهر 1403 1

- تیر 1403 4

- خرداد 1403 6

- فروردین 1403 2

- اسفند 1402 2

- بهمن 1402 2

- دی 1402 2

- آبان 1402 2

- خرداد 1402 1

- خرداد 1401 5

- اردیبهشت 1401 3

- فروردین 1401 6

- بهمن 1400 3

- دی 1400 9

- آذر 1400 2

- اردیبهشت 1400 3

- فروردین 1400 1

- اسفند 1399 3

- دی 1399 4

- آذر 1399 7

- مهر 1399 1

- تیر 1399 2

- فروردین 1399 1

- دی 1398 4

- آذر 1398 5

- آبان 1398 7

- مهر 1398 38

- خرداد 1398 3

- اردیبهشت 1398 7

- فروردین 1398 10

- اسفند 1397 5

- آذر 1397 4

- آبان 1397 4

- تیر 1397 3

- خرداد 1397 4

- اردیبهشت 1397 2

- فروردین 1397 1

- بهمن 1396 33

- دی 1396 1

- مهر 1396 11

- مرداد 1396 2

- تیر 1396 1

- خرداد 1396 4

- اردیبهشت 1396 1

- فروردین 1396 1

- بهمن 1395 11

- دی 1395 2

- آذر 1395 8

- آبان 1395 1

- شهریور 1395 4

- مرداد 1395 5

- تیر 1395 2

- خرداد 1395 23

- اردیبهشت 1395 18

- فروردین 1395 38

- اسفند 1394 18

- آذر 1394 2

- مهر 1394 7

- شهریور 1394 1

- مرداد 1394 3

- خرداد 1394 11

- اردیبهشت 1394 6

- فروردین 1394 9

- اسفند 1393 1

- بهمن 1393 2

- دی 1393 12

- آذر 1393 2

- شهریور 1393 7

- تیر 1393 5

- خرداد 1393 9

- اردیبهشت 1393 2

- فروردین 1393 3

- اسفند 1392 7

- بهمن 1392 7

- دی 1392 1

- آذر 1392 32

- آبان 1392 39

- مهر 1392 10

- مرداد 1392 2

- تیر 1392 5

- خرداد 1392 1

- اسفند 1391 1

- بهمن 1391 4

- دی 1391 13

- آذر 1391 19

- آبان 1391 33

- مهر 1391 9

- شهریور 1391 4

- مرداد 1391 9

- تیر 1391 11

- خرداد 1391 3

- اردیبهشت 1391 9

- دی 1390 9

- آذر 1390 49

- آبان 1390 13

- مهر 1390 6

- شهریور 1390 5

- مرداد 1390 29

- تیر 1390 38

- خرداد 1390 21

- اردیبهشت 1390 2

- فروردین 1390 12

- اسفند 1389 4

- بهمن 1389 4

- آبان 1389 1

- شهریور 1389 33

- مرداد 1389 24

- تیر 1389 14

- خرداد 1389 29

- اردیبهشت 1389 2

- فروردین 1389 3

- اسفند 1388 4

- بهمن 1388 18

- دی 1388 20

- آذر 1388 6

- آبان 1388 6

- مهر 1388 48

- شهریور 1388 152

accounting equation

accounting equation

accounting equation (or basic accounting equation) offers us a simple way to

understand how these three amounts relate to each other. The accounting equation for a sole proprietorship is:

The accounting equation for a corporation is:

Assets are a company’s resources—things the company owns. Examples of assets include cash, accounts receivable, inventory, prepaid insurance, investments, land, buildings, equipment, and goodwill. From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity.

Liabilities are a company’s obligations—amounts the company owes. Examples of liabilities include notes or loans payable, accounts payable, salaries and wages payable, interest payable, and income taxes payable (if the company is a regular corporation). Liabilities can be viewed in two ways:

(1) as claims by creditors against the company’s assets, and

(2) a source—along with owner or stockholder equity—of the company’s assets.

Owner’s equity or stockholders’ equity is the amount left over after liabilities are deducted from assets:

Assets – Liabilities = Owner’s (or Stockholders’) Equity.

Owner’s or stockholders’ equity also reports the amounts invested into the company by the owners plus the cumulative net income of the company that has not been withdrawn or distributed to the owners.

If a company keeps accurate records, the accounting equation will always be “in balance,” meaning the left side should always equal the right side. The balance is maintained because every business transaction affects at least two of a company’s accounts. For example, when a company borrows money from a bank, the company’s assets will increase and its liabilities will increase by the same amount. When a company purchases inventory for cash, one asset will increase and one asset will decrease. Because there are two or more accounts affected by every transaction, the accounting system is referred to as double entry accounting.

A company keeps track of all of its transactions by recording them in accounts in the company’s general ledger. Each account in the general ledger is designated as to its

type: asset, liability, owner’s equity, revenue, expense, gain, or loss account.

Balance Sheet and Income Statement

The balance sheet is also known as the statement of financial position and it reflects the accounting equation. The balance sheet reports a company’s assets, liabilities, and owner’s (or stockholders’) equity at a specific point in time. Like the accounting equation, it shows that a company’s total amount of assets equals the total amount of liabilities plus owner’s (or stockholders’) equity.

The income statement is the financial statement that reports a company’s revenues and expenses and the resulting net income. While the balance sheet is concerned with one point in time, the income statement covers a time interval or period of time. The income statement will explain part of the change in the owner’s or stockholders’ equity during the time interval between two balance sheets.

Sole Proprietorship Transaction #1.

Let’s assume that J. Ott forms a sole proprietorship called Accounting Software Co. (ASC). On December 1, 2009, J. Ott invests personal funds of $10,000 to start ASC. The effect of this transaction on ASC’s accounting equation is:

| Assets | = | Liabilities | + | Owner’s Equity | |

| +$10,000 | = | No Effect | + | +$10,000 |

As you can see, ASC’s assets increase by $10,000 and so does ASC’s owner's equity. As a result, the accounting equation will be in balance.

You can interpret the amounts in the accounting equation to mean that ASC has assets of $10,000 and the source of those assets was the owner, J. Ott. Alternatively, you can view the accounting equation to mean that ASC has assets of $10,000 and there are no claims by creditors (liabilities) against the assets. As a result, the owner has a claim for the remainder or residual of $10,000.

This transaction is recorded in the asset account Cash and the owner’s equity account J. Ott, Capital. The general journal entry to record the transactions in these accounts is:

| Date | Account Titles | Debit | Credit |

| Dec. 1, 2009 | Cash | 10,000 | |

| J. Ott, Capital | 10,000 |

After the journal entry is recorded in the accounts, a balance sheet can be prepared to show ASC’s financial position at the end of December 1, 2009:

| Accounting Software Co. | ||||||

| Balance Sheet | ||||||

| December 1, 2009 | ||||||

| ASSETS | LIABILITIES | |||||

| Cash | $ | 10,000 | OWNER’S EQUITY | |||

| . | J. Ott, Capital | $ | 10,000 | |||

| Total Assets | $ | 10,000 | Total Liab & Owner's Equity | $ | 10,000 | |

| . | ||||||

The purpose of an income statement is to report revenues and expenses. Since ASC has not yet earned any revenues nor incurred any expenses, there are no transactions to be reported on an income statement.

Sole Proprietorship Transaction #2.

On December 2, 2009 J. Ott withdraws $100 of cash from the business for his personal use. The effect of this transaction on ASC’s accounting equation is:

| Assets | = | Liabilities | + | Owner’s Equity | |

| –$100 | = | No Effect | + | –$100 |

The accounting equation remains in balance since ASC’s assets have been reduced by $100 and so has the owner’s equity.

This transaction is recorded in the asset account Cash and the owner’s equity account J. Ott, Drawing. The general journal entry to record the transactions in these accounts is:

| Date | Account Titles | Debit | Credit |

| Dec. 2, 2009 | J. Ott, Drawing | 100 | |

| Cash | 100 |

Since the transactions of December 1 and 2 were each in balance, the sum of both transactions should also be in balance:

| Transaction | Assets | = | Liabilities | + | Owner’s Equity |

| 1 | +$10,000 | = | No Effect | + | +$10,000 |

| 2 | –$100 | = | No Effect | + | –$100 |

| Totals | $9,900 | = | $0 | + | $9,900 |

The totals indicate that ASC has assets of $9,900 and the source of those assets is the owner of the company. You can also conclude that the company has assets or resources of $9,900 and the only claim against those resources is the owner’s claim.

The December 2 balance sheet will communicate the company’s financial position as of midnight on December 2:

| Accounting Software Co. | ||||||

| Balance Sheet | ||||||

| December 2, 2009 | ||||||

| ASSETS | LIABILITIES | |||||

| Cash | $ | 9,900 | OWNER’S EQUITY | |||

| . | J. Ott, Capital | $ | 9,900* | |||

| Total Assets | $ | 9,900 | Total Liab & Owner's Equity | $ | 9,900 | |

| . | ||||||

| . | |||||

| Beginning Owner's Equity | $ | 0 | |||

| + Owner's Investment | + | 10,000 | |||

| + Net Income | + | 0 | |||

| Subtotal | $ | 10,000 | |||

| – Owner's Draws | – | 100 | |||

| Ending Owner's Equity at Dec. 2 | $ | 9,900* | |||

| . | |||||

Withdrawals of company assets by the owner for the owner’s personal use are known as “draws.” Since draws are not expenses, the transaction is not reported on the company’s income statement.

Receive 80 essential business forms—professionally designed to

increase your understanding of business and financial accounting.

Created with the amazing clarity of AccountingCoach.com. Read 1,200+ user testimonials.

All business forms come in two formats (you get both):

| Financial Statements Forms |  PDF Form PDF Form |  PDF Form PDF Form(Filled in) |

| Balance Sheet: Manufacturer - Corporation |  |  |

| Balance Sheet: Retail/Wholesale - Corporation |  |  |

| Balance Sheet: Retail/Wholesale - Sole Proprietor |  |  |

| Balance Sheet: Services - Corporation |  |  |

| Balance Sheet: Services - Sole Proprietor |  |  |

| Cost of Goods Manufactured |  |  |

| Income Statement: Manufacturer - Corporation, Multiple-Step |  |  |

| Income Statement: Manufacturer - Corporation, Single-Step |  |  |

| Income Statement: Retail/Whsle - Corporation, Multiple-Step |  |  |

| Income Statement: Retail/Whsle - Corporation, Single-Step |  |  |

| Income Statement: Retail/Whsle - Sole Proprietor, Multiple-Step |  |  |

| Income Statement: Retail/Whsle - Sole Proprietor, Single-Step |  |  |

| Income Statement: Services - Corporation |  |  |

| Income Statement: Services - Sole Proprietor |  |  |

| Personal Financial Information |  |  |

| Selling, General and Administrative (SG&A) Expenses |  |  |

| Statement of Cash Flows: Corporation, Indirect Method |  |  |

| Statement of Cash Flows: Sole Proprietor, Indirect Method |  |  |

| Statement of Owner's Equity: Sole Proprietor |  |  |

| Financial Ratios and Analysis Forms |  PDF Form PDF Form |  PDF Form PDF Form(Filled in) |

| Working Capital |  |  |

| Working Capital to Total Assets |  |  |

| Working Capital Turnover Ratio |  |  |

| Current Ratio |  |  |

| Quick Ratio or Acid Test Ratio |  |  |

| Accounts Receivable Turnover |  |  |

| Days Sales in Accounts Receivable |  |  |

| Inventory Turnover Ratio |  |  |

| Days Sales in Inventory |  |  |

| Fixed Asset Turnover Ratio |  |  |

| Total Assets Turnover Ratio |  |  |

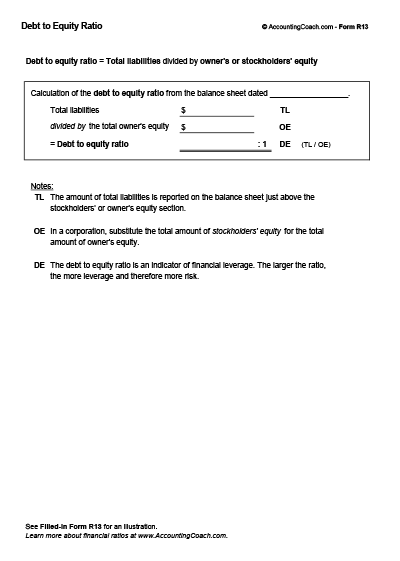

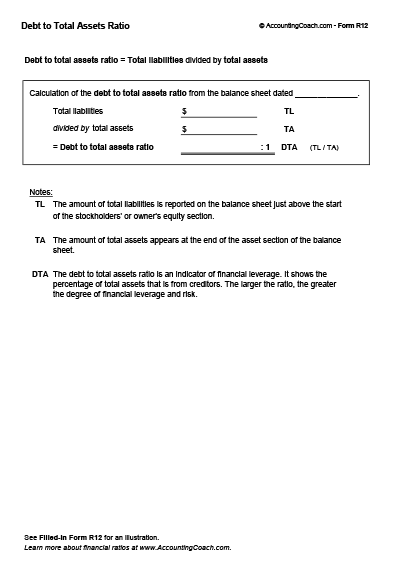

| Debt to Total Assets Ratio |  |  |

| Debt to Equity Ratio |  |  |

| Equity Ratio |  |  |

| Equity Turnover Ratio |  |  |

| Times Interest Earned |  |  |

| Profit Margin after Tax |  |  |

| Gross Profit Margin |  |  |

| Return on Total Assets |  |  |

| Return on Stockholders' Equity |  |  |

| EBITDA |  |  |

| Book Value per Share of Common Stock |  |  |

| Free Cash Flow |  |  |

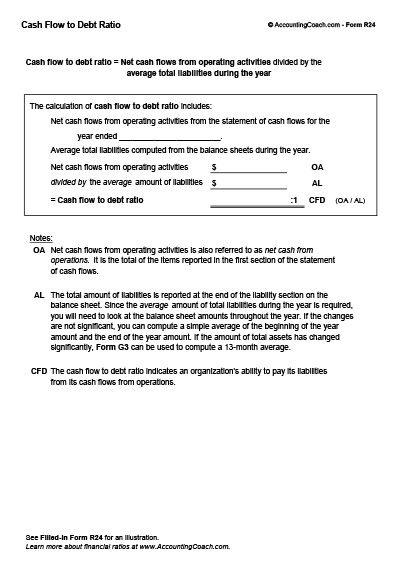

| Cash Flow to Debt Ratio |  |  |

| Break-even Point, Contribution Margin, Cost-Volume-Profit Forms |  PDF Form PDF Form |  PDF Form PDF Form(Filled in) |

| Break-even Point in Units (one product or one service) |  |  |

| Break-even Point in Dollars (one product or one service) |  |  |

| Break-even Point in Dollars (multiple products or services) |  |  |

| Contribution Margin Calculations |  |  |

| Contribution Margin Income Statement: Retail/Wholesale |  |  |

| Contribution Margin Income Statement: Service Business |  |  |

| High-low Method |  |  |

| Sales Needed for Desired Net Income (single or multiple products/services) |  |  |

| Depreciation and Amortization Forms |  PDF Form PDF Form |  PDF Form PDF Form(Filled in) |

| Depreciation: Straight-line Method |  |  |

| Depreciation: Double Declining Balance (DDB) Method |  |  |

| Depreciation: Sum of the Years' Digits Method |  |  |

| Depreciation: Units of Activity Method |  |  |

| Amortization of Bond Discount: Effective Interest Method |  |  |

| Amortization of Bond Discount: Straight-line Method |  |  |

| Amortization of Bond Premium: Effective Interest Method |  |  |

| Amortization of Bond Premium: Straight-line Method |  |  |

| General Forms |  PDF Form PDF Form |  PDF Form PDF Form(Filled in) |

| Aging of Accounts Payable |  |  |

| Aging of Accounts Receivable |  |  |

| Average: 13 month |  |  |

| Bank Reconciliation |  |  |

| Bank Reconciliation Outstanding Checks |  |  |

| Check Request Form |  |  |

| Current Portion of Long-term Debt |  |  |

| Economic Order Quantity (EOQ) |  |  |

| Inventory: Estimating Using the Gross Profit Method |  |  |

| Inventory: Estimating Lost or Missing Amounts |  |  |

| Items Requiring Attention |  |  |

| Money Counter's Tally |  |  |

| Present Value Calculation |  |  |

| Standard Costing: Direct Labor Rate & Efficiency Variances |  |  |

| Standard Costing: Direct Materials Price Variance |  |  |

| Standard Costing: Direct Materials Usage Variance |  |  |

| Standard Costing: Fixed Manufacturing Overhead Variances |  |  |

| Standard Costing: Variable Manufacturing Overhead Variances |  |  |

| To Do List |  |  |

| Trial Balance |  |  |

| Worksheet: Trial Balance and Adjustments |  |  |

Scroll down to view all the forms included in The Master Set of 80 Business Forms.

Sole Proprietorship Transaction #3.

On December 3, 2009 Accounting Software Co. spends $5,000 of cash to purchase computer equipment for use in the business. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Owner’s Equity | |

| +$5,000 | = | No Effect | + | No Effect | |

| –$5,000 |

The accounting equation reflects that one asset increases and another asset decreases. Since the amount of the increase is the same as the amount of the decrease, the accounting equation remains in balance.

This transaction is recorded in the asset accounts Equipment and Cash. Equipment increases by $5,000, and Cash decreases by $5,000. The general journal entry to record the transactions in these accounts is:

The combined effect of the first three transactions is shown here:

| Transaction | Assets | = | Liabilities | + | Owner’s Equity |

| 1 | +$10,000 | = | No Effect | + | +$10,000 |

| 2 | –$100 | = | No Effect | + | –$100 |

| 3 | +$5,000 | = | No Effect | + | No Effect |

| –$5,000 | |||||

| Totals | $9,900 | = | $0 | + | $9,900 |

The totals tell us that the company has assets of $9,900 and the source of those assets is the owner of the company. It also tells us that the company has assets of $9,900 and the only claim against those assets is the owner’s claim.

The balance sheet dated December 3, 2009 will reflect the financial position as of midnight on December 3:

| Accounting Software Co. | ||||||

| Balance Sheet | ||||||

| December 3, 2009 | ||||||

| ASSETS | LIABILITIES | $ | 0 | |||

| Cash | $ | 4,900 | OWNER’S EQUITY | |||

| Equipment | 5,000 | J. Ott, Capital | $ | 9,900* | ||

| Total Assets | $ | 9,900 | Total Liab & Owner's Equity | $ | 9,900 | |

| . | ||||||

| . | |||||

| Beginning Owner's Equity | $ | 0 | |||

| + Owner's Investment | + | 10,000 | |||

| + Net Income | + | 0 | |||

| Sub Total | $ | 10,000 | |||

| – J. Ott, Drawing | – | 100 | |||

| Ending Owner's Equity at Dec. 3 | $ | 9,900* | |||

| . | |||||

The purchase of equipment is not an immediate expense. It will become part of depreciation expense only after it is placed into service. We will assume that as of December 3 the equipment has not been placed into service, therefore, no expense will appear on an income statement for the period of December 1 through December 3.

Sole Proprietorship Transaction #4.

On December 4, 2009 ASC obtains $7,000 by borrowing money from its bank. The effect of this transaction on the accounting equation is:

| Assets | = | Liabilities | + | Owner’s Equity | |

| +$7,000 | = | +$7,000 | + | No Effect |

As you can see, ASC’s assets increase and ASC’s liabilities increase by $7,000.

This transaction is recorded in the asset accountCash and the liability account Notes Payable as shown in this accounting entry:

| Date | Account Titles | Debit | Credit |

| Dec. 4, 2009 | Cash | 7,000 | |

| Notes Payable | 7,000 |

The combined effect on the accounting equation from the first four transactions is available here:

| Transaction | Assets | = | Liabilities | + | Owner’s Equity |

| 1 | +$10,000 | = | No Effect | + | +$10,000 |

| 2 | –$100 | = | No Effect | + | –$100 |

| 3 | +$5,000 | = | No Effect | + | No Effect |

| –$5,000 | |||||

| 4 | +$7,000 | = | +$7,000 | + | No Effect |

| Totals | $16,900 | = | $7,000 | + | $9,900 |

The totals indicate that the transactions through December 4 result in assets of $16,900. There are two sources for those assets–the creditors provided $7,000 of assets, and the owner of the company provided $9,900. You can also interpret the accounting equation to say that the company has assets of $16,900 and the lenders have a claim of $7,000 and the owner has a claim for the remainder.

The balance sheet dated December 4 will report ASC’s financial position as of that date:

| Accounting Software Co. | |||||

| Balance Sheet | |||||

| December 4, 2009 | |||||

| ASSETS | LIABILITIES | ||||

| Cash | $ | 11,900 | Notes Payable | $ | 7,000 |

| Equipment | 5,000 | OWNER’S EQUITY | |||

| . | J. Ott, Capital | $ | 9,900* | ||

| Total Assets | $ | 16,900 | Total Liab & Owner's Equity | $ | 16,900 |

| . | |||||

| . | |||||

| Beginning Owner's Equity | $ | 0 | |||

| + Owner's Investment | + | 10,000 | |||

| + Net Income | + | 0 | |||

| Subtotal | $ | 10,000 | |||

| – J. Ott, Drawing | – | 100 | |||

| Ending Owner's Equity at Dec. 4 | $ | 9,900* | |||

| . | |||||